Hope you and yours are keeping safe (and sane).

Welcome to the latest edition of Sunday Reads, where we'll look at a topic (or more) in business, strategy, or society, and use them to build our cognitive toolkits for business.

If you’re new here, don’t forget to check out the compilation of my best articles: The best of Jitha.me. I’m sure you’ll find something you like.

And here’s my newsletter from last week, in case you missed it: Sunday Reads #111: How would you discount your life?

This week, we first look at how (and why) our best intentions often don’t only fall short of our goals, but also have unintended consequences. It always takes us by surprise. And yet, it’s always so predictable.

Next, we look at the stock markets. Is there a way to systematically pick big winners?

And we end with our chart of the week. On what the vaccine development efforts mean for the pandemic’s end-game.

Here's the deal - Dive as deep as you want. Read my thoughts first. If you find them intriguing, read the main articles. If you want to learn more, check out the related articles and books.

[PS. If you like what you see, do forward to your friends. They can sign up with the button below.]

Oops! I did it again...

As Hong Kong continues to battle with Wave #4 of COVID, the government has announced an incentive to encourage people to get tested. The city will offer anyone who tests positive for COVID a handout of HKD 5,000 (USD 645).

Ingenious. What a great scheme! Surely nothing can go wrong here. <sarcasm: off>

And true enough, a week later:

I haven't been able to fact-check this picture. Anyway, if it isn't already true, it will be soon enough.

For you see, this is a law of nature. It's called Goodhart's Law:

"When a measure becomes a target, it ceases to be a good measure."

There are examples of this everywhere.

The most cited example is a Soviet-era nail factory:

Once upon a time, there was a factory in the Soviet Union that made nails. Moscow set quotas on their nail production, and they began working to meet the quotas as described, rather than doing anything useful.

When they set quotas by quantity, they churned out hundreds of thousands of tiny, useless nails.

When Moscow realized this was not useful and set a quota by weight instead, they started building big, heavy railroad spike-type nails that weighed a pound each.

Noah Brier has another example, of the New York Police Department in the mid-90s. At that time, the NYPD had just implemented Compstat, a new system to measure crime.

Some chiefs started to figure out, wait a minute, the person who's in charge of actually keeping track of the crime in my neighborhood is me. And so if they couldn’t make crime go down, they just would stop reporting crime.

And they found all these different ways to do it. You could refuse to take crime reports from victims, you could write down different things than what had actually happened. You could literally just throw paperwork away.

And so that guy would survive that CompStat meeting, he’d get his promotion, and then when the next guy showed up, the number that he had to beat was the number that a cheater had set. And so he had to cheat a little bit more.

More about this in the Wikipedia article on Compstat.

From David Perell, on hospitals:

One hospital took too long to admit patients so a penalty was given for 4+ hour wait times. In response, ambulance drivers were asked to slow down so they could shorten wait times.

And of course, this happens with COVID testing too.

As I mentioned in Sunday Reads #85: Black Swans, Honesty, and Dishonest Statistics,

In a country where the reported number of new cases is declining, the situation could actually be getting worse, ... because it’s ramping down on testing for PR reasons.

And as of June, this is exactly what was happening in India. Re-pasting from Sunday Reads #96 this time,

States seem to be scaling back on corona tests so that they can pretend the epidemic is under control. What’s going on is that states are in competition to flatten the number-of-cases curve.

State governments do not want people to be tested. Doctors and labs have been sent the message. After all, if you don’t test, you can’t have any cases, can you?

Delhi conducted 12% less tests in the week of 2-8 June than in that of 26 May-1 June. This, while the number of confirmed cases rose 34%, and deaths rose 67%. About one in three people being tested currently is turning out to be corona-positive.

Well, we get the behavior we reward. We flatten the curve we track, not the one we need to flatten.

My favorite example of Goodhart's Law though, is from India under British rule. The rulers decided to combat the menace of poisonous cobras in Delhi, by offering the citizens a bounty on killing them. The rest, as they say, is history:

The British government was concerned about the number of venomous cobras in Delhi. The government therefore offered a bounty for every dead cobra.

Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income.

When the government became aware of this, the reward program was scrapped. When cobra breeders set their now-worthless snakes free, the wild cobra population further increased.

A similar thing happened with The Great Hanoi Rat Massacre of 1902.

This happens in business too.

If your sales team's bonus is based on the number of deals they close, guess what: they'll have several small deals to show at the end of the year.

That's if you're lucky.

If you're unlucky, the deals will also be loss-making.

You may laugh at this simple example. But how often does it happen that when your team has a stretch sales target, the profit margin ends up lower than usual?

And what's true of a sales team can be true of an entire industry too.

As I mention in Digital advertising doesn't work. And marketers don't care.:

You know the saying "What gets measured gets managed". Google and Facebook report clicks and impressions, not actual incremental purchases. So that's what marketers track and optimize. They don't track incremental purchases, because there's no way to track that.

In a sense, Marketers are Addicted to Bad Data.

Given this pervasiveness (and sheer brutality) of Goodhart's Law, I prefer Zvi Mowshowitz's stronger version of the adage:

Sufficiently Powerful Optimization Of Any Known Target Destroys All Value

OK, so how do you resolve this?

The moral of the story is: You get the behavior you reward.

Therefore, it's tempting to offer a general principle. Incentivize as close to the desired outcome as possible.

But this is not actionable enough.

Many times, your desired outcome (e.g., how many purchases does your digital campaign drive) may not be trackable at all!

Sooner or later, you have to resort to metrics which are a little distant from the desired outcome. And then, the gaming begins.

A better solution is to use pairs of indicators.

Measure both the desired effect, and the undesired counter-effect.

For every goal you put in front of someone, you should also put in place a counter-goal to restrict gaming of the first goal - Andy Grove

For example:

If you want to increase factory throughput, don't just measure throughput (no. of widgets per day). Also measure the quality levels.

If you want your Finance team to close books in time, measure the timeliness. But also measure accuracy.

If you want to drive sales, don't just incentivize $$ value of sales. Also measure profitability.

The World of Stock Markets: How to find the big winners?

Can you name the top 8 S&P 500 stocks of the last 10 years? Maybe jot them down in your notebook before proceeding.

Done? Now tell me how many you got right.

Amazon, sure. Netflix, check. Nvidia - yes, it was on my list. But Domino's? And what does MarketAxess do anyway?

Well, as a retail investor, this is one of the downsides of picking individual stocks, instead of an ETF.

The stocks that you've heard of and think are worth investing in - everybody has heard of them, and believes that too. So there's a sort of "popularity premium" built in, which reduces your returns.

So how do you find the multi-baggers; the stocks that are most under valued today?

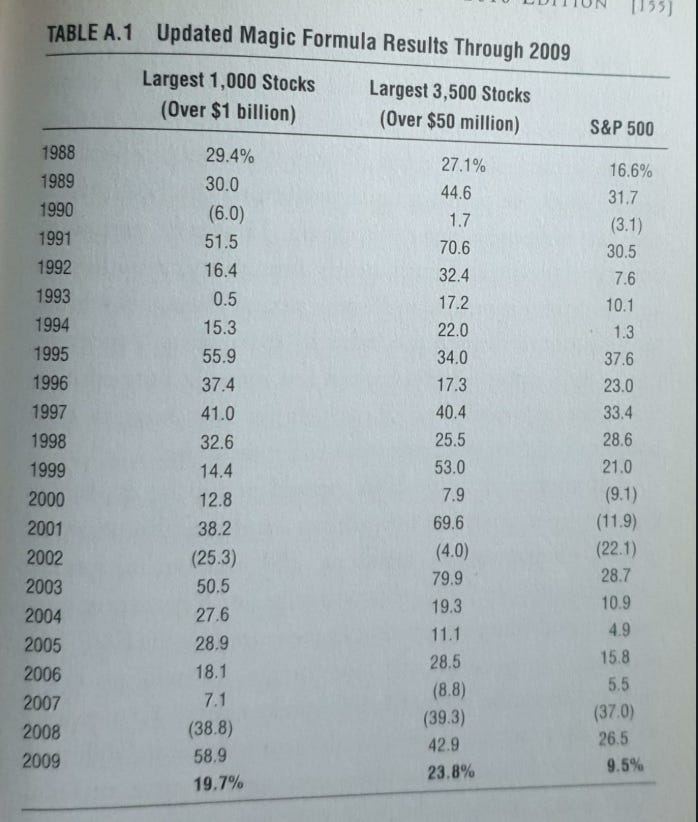

Joel Greenblatt has a "magic formula", which he's described in The Little Book that Still Beats the Market and The Big Secret for the Small Investor. (I'll share my notes from these books soon).

It's a simple concept. As he says, there are only two principles to beating the market:

Buy good stocks - i.e., companies that have high ROI on invested capital.

Buy them at bargain prices - i.e., a high earnings yield, or a low price to earnings ratio.

Rank all the stocks in your consideration set by these two criteria - high ROI and high earnings yield - and invest only in the top ones.

In short, the formula works by buying above average companies at below average prices.

That's it??

Sounds simple, almost deceptively so.

Why would such a simple formula work? Wouldn't everyone jump on this, and bid up the prices?

Turns out it doesn't always work, over shorter time intervals. One in every 4 years, it would underperform the market. Once in every six two-year periods, it would underperform the market.

Now, who would stick around with such a simple formula, when it underperforms the market for a full year? How about two years?

You’re right. Very few would.

That’s the secret. That's why it has worked over longer time intervals.

[Image Source: The Little Book that Still Beats the Market]

Hmm. Seems worth trying for a proportion of one's investments.

Chart of the Week.

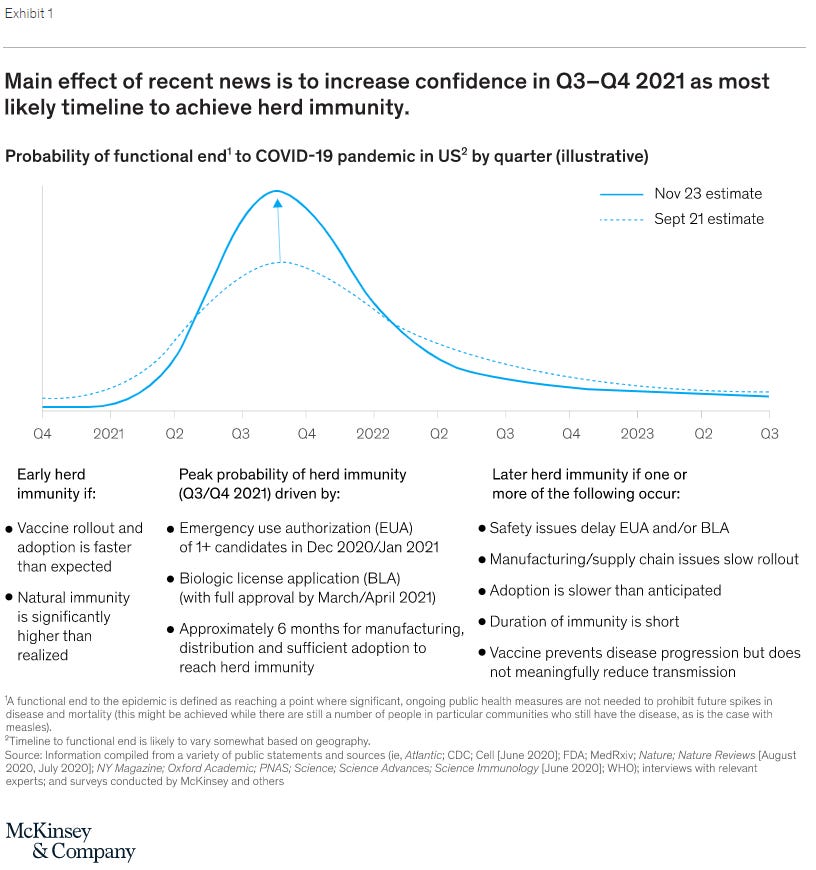

McKinsey has published a great analysis on the end-game of the pandemic, now that a vaccine (or several) is in sight.

The article answers the question: Is an earlier end to the pandemic now more likely?

The short answer is that the latest developments serve mainly to reduce the uncertainty of the timeline. The positive readouts from the vaccine trials mean that the United States will most likely reach an epidemiological end to the pandemic (herd immunity) in Q3 or Q4 2021.

An earlier timeline to reach herd immunity—for example, Q1/Q2 of 2021—is now less likely, as is a later timeline (2022).

A lot to be thankful for. The world put a lot of pressure on biotech and pharma companies, and they are delivering.

Do read the article for more detailed analyses, including different scenarios of vaccine efficacy and coverage. It's more US oriented, but interesting reading for the rest of us too.

That's it for this week! Hope you liked the articles. Drop me a line (just hit reply or leave a comment through the button below) and let me know what you think.

See you next week!

Jitha