Sunday Reads #117: How the Gamestonk game will stop.

Would you believe game theory has the answer? 😜

Welcome to the latest edition of Sunday Reads, where we'll look at a topic (or more) in business, strategy, or society, and use them to build our cognitive toolkits for business.

If you’re new here, don’t forget to check out the compilation of my best articles: The best of Jitha.me. I’m sure you’ll find something you like.

And here’s the last edition of my newsletter, in case you missed it: Sunday Reads #116: How to become stronger (not just at the gym).

This week, I was going to write about the megatrend towards remote work (we're never going back to the office). But something far more interesting happened, and so I decided to write about that instead.

You guessed it, Gamestop. It’s a fascinating story, with the twists and turns of a fast-paced thriller. But even as the day-to-day becomes more volatile, the end is becoming more predictable. From a game theory perspective, at least.

(And if you don’t know what Gamestop is, worry not. I’ll explain below).

Here's the deal - Dive as deep as you want. Read my thoughts first. If you find them intriguing, read the main articles. If you want to learn more, check out the related articles and books.

[PS. If you like what you see, do forward to your friends. They can sign up with the button below.]

1. Gamestonk! And how it's likely to end.

First, the unbelievable story itself.

If you've not been following the Gamestop saga (or GameStonk, as Elon Musk called it), here's a quick description of what's going down:

Some Reddit users on the r/wallstreetbets subreddit identified Game Stop (stock ticker: GME) as an undervalued stock in 2019.

This small subset of users, ignored by the mainstream, started to slowly buy shares of the company, in the hope that the price would go up.

At the same time, several Wall Street hedge funds were taking the opposite side of the trade. They were shorting the stock heavily - i.e., borrowing shares and selling them, in the hope that the price would fall.

As hedge funds piled onto the short side of the trade, Game Stop became one of the most shorted stocks in the stock market. At one point, the amount of short interest was more than 130% of the outstanding shares of the company!

The r/wallstreetbets community realized that Wall Street was over-indexed on the short trade, and decided to "short squeeze" them. They started buying heavily and bidding the price up, making the short sellers more and more desperate.

Quick sidenote: How does a short squeeze work?

Here's a quick explanation of how a "short squeeze" works. (I've linked to a couple of better explanations at the bottom).

If you "sell a stock short" (i.e., sell a stock you don't have), you need to buy it to fulfil the sale at some point. And the higher the price goes, the more it'll cost you to buy the stock and fulfil the sale. This is a short squeeze. The longer you wait, the worse it becomes.

And guess what happens when you start buying to cover your short? The stock price goes up even higher.

Back to the story.

That's what happened with GME. As r/wallstreetbets bought to drive up the price, and the hedge funds bought to cover their shorts, the price went vertical.

One hedge fund (Melvin Capital) almost went bankrupt due to the short squeeze, and had to be bailed out. Others were sweating buckets.

This was as of Wednesday Jan 27.

Nicolas Cole has written a great thread about the rollercoaster ride this has been, for the Redditors leading the charge.

It's a fairytale David vs. Goliath story, about a ragtag team of amateurs taking on the mighty Titans. Victory seemed imminent.

And then, suddenly, Robinhood stopped allowing its users to buy GME stock.

What! How brazenly is the stock market rigged against the small guy?

You can imagine the fury against Robinhood when this happened.

Class action suits have been filed. Hit pieces have been written. And well, Robinhood's CEO was maybe the most hated person on the Internet for a couple of days.

After all, here was one more clear example of how everything's stacked against the small guy. As AOC put it, hedge funds have always treated the economy as a casino, so it's a bit rich of them to now prevent some users on a message board from doing the same.

The truth, however, is a little more prosaic:

Robinhood and other platforms had no choice but to shut trading on that day.

As per regulations, brokers have to place collateral with the settlement authority for the trades they carry out. And the more volatile the underlying stock's price, the greater the collateral required. Collateral which wasn't exactly sitting around in Robinhood's bank account.

So Robinhood had no choice but to pause trading, while it scrambled to raise $1 Billion from its investors in less than 24 hours. And it has since allowed its users "limited ability" to trade the GME stock.

Balaji Srinivasan has a more detailed explanation of this.

But everyone's missing the most important part of the story.

Everyone except Eliezer Yudkowsky, that is.

As he says in /r/WallStreetBets is trying something unprecedented in history — and the media’s not reporting on it at all,

The last I heard, Gamestop had 130% short interest outstanding. That is, short-sellers have collectively borrowed, and now collectively owe, 130% as much Gamestop stock as exists anywhere.

This happens, from time to time, in stock markets. When it does, it creates an opportunity for hedge funds to make a daring play. If a hedge fund can buy up enough of the company stock themselves, they can hold enough that the short-sellers have to go to the hedge fund to buy back the stock. In principle of purely theoretical examples, the hedge fund could charge infinity dollars for the stock, assuming the short-sellers had infinity dollars to pay them.

But so far as I know, this scheme has never before been successfully carried out by a large group of retail investors instead of a hedge fund… A group of retail investors face a technically interesting coordination problem in trying to engineer a short squeeze, a problem that one monolithic hedge fund does not face. So I will be really interested if /r/WallStreetBets pulls it off successfully, or even mostly successfully.

That’s the part that would be front-page news on my home planet: “Group of unprecedented size daringly challenges a never-before-solved difficult coordination problem, with billions of dollars at stake! They’ve made huge progress, but their critical difficulty is still to come!”

This is the most important part. This scheme only works if enough buyers continue to hold and bid up the price. Even as short-sellers get more and more desperate to buy and cover their position.

This is easy if you're a monolithic hedge fund (or a cozy bunch of hedge funds at an "idea dinner"). But it's incredibly difficult (I'd have said "impossible" a month ago) when you're a million YOLO guys on Reddit.

What they've pulled off is amazing.

But wait, Yudkowsky said "their critical difficulty is still to come!"?

Yes, and therein lies the rub.

How this will end - for the Redditors.

Well, unfortunately, this raid will fail (degree of belief: 90%).

Some of the Redditors will make a lot of money. But most will be left holding a worthless stock, when the price succumbs to gravity.

But wait, you say! If the short interest outstanding is 130%, that's more than the amount of stock available. So, the hedge funds will eventually have to buy back the stock from everyone holding the stock. Right?

Well, no. And I hadn't understood this before.

Back to Yudkowsky:

If there are 130% outstanding short positions, that means there are 230% outstanding long positions. So when you are engineering a short squeeze, not all of the stock the squeezers hold, can be sold back to short-sellers at the ultra-high price.

Let’s go back to Alice through Eileen again. Alice buys 100 shares of GlomCo to hold, her broker quietly loans the actual shares to Bob, who sells them to Carol, whose broker quietly loans the shares to Dennis, who sells them to Eileen. At the end of this operation, 200 shares of GlomCo, or 200% of the whole company, are collectively owed by Bob and Dennis; but Alice, Carol, and Eileen collectively think they own 300% of GlomCo.

Even though Eileen thinks that she owns 100% of the total GlomCo stock in actual existence, and even though Bob and Dennis have borrowed 200% of GlomCo, there’s no guarantee that Eileen could sell any of her stock to Bob and Dennis during a short squeeze. If Eileen demands a high price, Bob and Dennis can just buy Alice’s and Carol’s collective 200 shares of GlomCo instead.

This is a very standard coordination problem (we've seen it before).

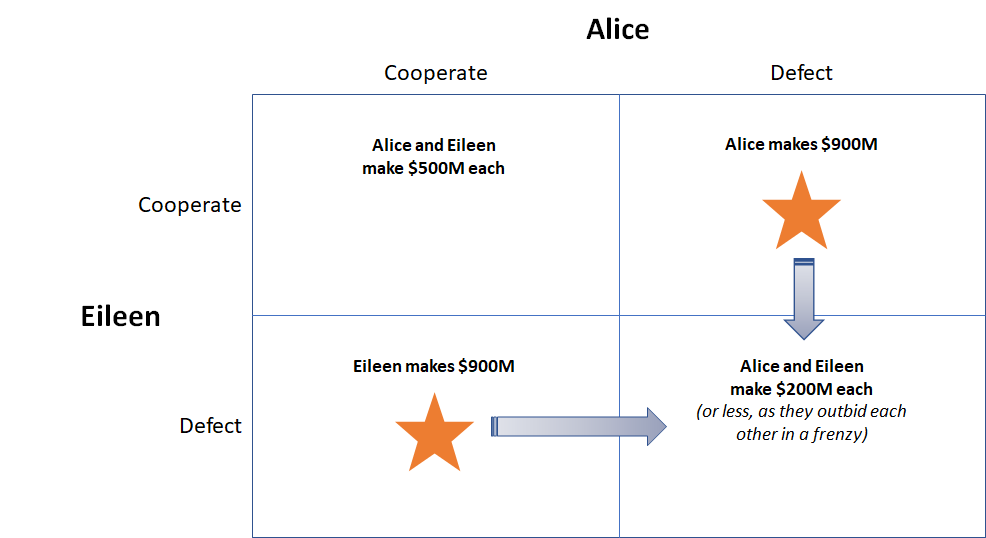

Let's simplify the illustration a little. Let's say there's only Eileen and Alice, and they both own 100 shares. A short-seller Moe moseys up to them, looking to buy 100 shares to cover his short. Eileen and Alice have already agreed between them that they'll each sell half their shares, at the exorbitant price of $10M a share (so Moe has to collectively pay $1B).

Now of course, Eileen could renege on the deal at the last minute. She could offer to sell all her shares to Moe at $900M. Moe would say yes in a heartbeat. He'd buy all his 100 shares from Eileen, saving $100M. And leaving Alice with squat.

And if Alice knows this too, she could renege first.

So, actually, Moe wouldn’t say yes to Eileen in a heartbeat. He’d take Eileen’s offer to Alice, and get her to reduce her price below $900M. And so on.

Let's draw out the payoff matrix:

Looks familiar? It's the standard Prisoners' Dilemma!

And the optimal solution to the one-off Prisoners' Dilemma (as opposed to an iterated game) is to defect. Players always make more money by defecting; by reneging and offering a better deal.

And remember, in the GME case, it's not 2 prisoners but millions. And only some of them need to defect!

So defect they will. A few will sell their shares. Seeing them, some more will. And soon the dam will break.

Wait!, you say. Am I accusing the Redditors of being sellouts?

Actually, I’m not. I'm not saying some Redditors will break their tacit agreement and sell out. I'm not saying they're evil.

All I'm saying is that the agreement is tacit (explicit collusion may in fact be illegal). And there is no clear event that they can all wait for, to decide when to sell.

I wrote about "schelling points" in Fortnite, Apple, and the Fate of the Metaverse:

In a negotiation, if you ask for 60% and then go down to 50%, you will be expected to dig your heels in. And so the counter-party will push less. If you say 47%, they’ll assume that you can give up more and will push until you find another persuasive new boundary.

That’s also why “just one more drink” is a very unstable compromise.

Some outcomes have intrinsic magnetism. Outcomes that are prominent, unique, simple, or have a precedent / logic, drive agreement towards them. Often, this eventual compromise point can be predicted in advance.

These focal points / likely outcomes are called “schelling points”.

That’s the problem. There is no clear "schelling point" for the Redditors to coordinate around.

Remember, the short-sellers don't need to buy from everyone. They only need to buy a proportion of the shares outstanding (~56%, in the case of GME).

Would you want to be one of the 44% holding a share worth zero?

Didn't think so. Then I guess you'd better sell soon…

Hmm. Let’s take a deep breath. Because this is still the best case scenario.

There's a worse scenario?

You bet there is.

There may be some hedge funds who have jumped in and started buying too, seeing the opportunity to create a short squeeze.

If enough hedge funds hold GME stock, the short sellers may not need to buy from the Redditors at all! They'd be able to buy all the stock they need from other greedy hedge funds.

This is a gloomy scenario. I would be very disappointed if this happens 😞.

How this will end - for the rest of us.

For all of us on the sidelines, so far this has been fun. And we've cheered as r/wallstreetbets stuck it to the Man.

But taking a long view, two things are clear:

The current financial system is antiquated. T+2 day settlement, collateral requirements, etc. all fail in extreme scenarios. And in our exponential era, extreme scenarios will happen again and again. The system will break, right when it needs to be strongest. You'll be locked out of your account right when your livelihood depends on you making a trade.

The system and its gatekeepers strongly favor the rich. In this case, the hedge funds could go on trading GME and covering their positions, even while retail investors were locked out.

That's the challenge with any centralized system. As ancient Romans asked, "Quis custodiet ipsos custodes?". Who watches the watchmen?

Well, the 21st century has an answer:

Once again, Balaji Srinivasan is there before the rest of us.

PS. If you’d like to read more about short squeezes, check out Kelly Bodwin’s and Chamath Palihapitiya’s great explanations. Also read @NeckarValue's fascinating thread on Resorts International, "the most catastrophic short play in modern times".

2. Five High ROI Concepts.

Shreyas Doshi wrote a great Twitter thread a few months ago, on five concepts with incredibly high ROI.

I’m still working my way through the links and references.

Great pointers to keep in mind, as we work to grow in our careers (Tsuyoku naritai!).

3. A fact that blew my mind.

Our eyes have evolved to detect only the wavelengths that pass through water! Detecting any other wavelengths would be useless, so evolution selected against it.

Infra-red eyesight is a superpower only in comics.

That's it for this week! Hope you liked the articles. Drop me a line (just hit reply or leave a comment through the button below) and let me know what you think.

See you next week!

Jitha

Excellent read especially for folks who are little clueless about GME conundrum when they hear all the buzz words.