Sunday Reads #126: There ain't no such thing as a free lunch.

The "black swan" that could crash crypto. Hidden in plain sight.

Hope you’re keeping safe and sane. It is a troubling time in many parts of the world.

Welcome to the latest edition of Sunday Reads, where we'll look at a topic (or more) in business, strategy, or society, and use them to build our cognitive toolkits for business.

If you’re new here, don’t forget to check out the compilation of my best articles: The best of Jitha.me. I’m sure you’ll find something you like.

And here’s the last edition of my newsletter, in case you missed it: Sunday Reads #125: The Fast and the Ferocious.

This week, let’s talk about crypto again - the black swan that could crash the market, and take crypto back several years. It’s hidden in plain sight.

And next, the state of play on COVID-19. A story in 3 charts.

Here's the deal - Dive as deep as you want. Read my thoughts first. If you find them intriguing, read the main articles. If you want to learn more, check out the related articles and books. Oh, and do subscribe if you haven’t 😊.

1. There ain't no such thing as a free lunch - Blockchain edition.

The biggest risk to the current crypto wave is, ironically, a stablecoin.

You can call it a "black swan". But in this case, it's entirely predictable.

It all comes down to one timeless truth: There ain't no such thing as a free lunch.

Back up a bit - what's a "stablecoin"?

Think of stablecoins as "digital dollars". They are cryptocurrency tokens like Bitcoin or Ether, but they track the value of real world currencies like US Dollars, Renminbi, etc.

There are many advantages of having digital versions of fiat currencies, as Tyler Cowen says here.

They enable instant cross-border transactions. They have very low transaction fees.

Why are stablecoins so central to cryptocurrency?

OK, so stablecoins are a digital version of the dollar. One of several kinds of cryptocurrencies. Why are they such a big deal?

Stablecoins are a hidden foundation of crypto today, in ways we don't realize.

Any fiat → crypto (or vice versa) trades on centralized exchanges like Coinbase / Binance happen via stablecoins.

Crypto is too volatile to safely convert directly into fiat.

Stablecoins are, well, stable. So, they are a good intermediate asset.

Thus, stablecoins are the liquidity providers for crypto.

This is critical to understand - *you can't actually buy Bitcoin with USD*. You buy it with USDT, USDC or BUSD (all stablecoins that track the US dollar). Even if it's invisible to you.

The process to buy ETH on Binance is a good illustration. I can't just buy it with USD. I have to first load USD into my Binance wallet. And I do that by using USD to buy BUSD, Binance's native stablecoin that tracks the dollar.

There's no way for me to convert dollars into crypto without some stablecoin in the middle.

This is the primary risk of stablecoins.

If there's a liquidity drought in USDT (we'll see why later), you will not be able to buy or sell Bitcoin anymore (or you could, with a massive haircut).

No choice but to HODL.

It would be OK if this was the only risk. With the amount of money that's currently in stablecoins, lack of liquidity doesn't look like a problem on the horizon.

But boy, are there more risks 😰.

To understand these risks, we need to ask a basic question.

How do stablecoins remove volatility?

I mentioned earlier that stablecoins are useful because they are stable cryptocurrencies. Whereas all other cryptocurrencies are volatile.

It's worth asking the question - how are stablecoins removing volatility from the system?

Making a volatile asset less volatile requires energy. Where's that energy coming from? Who's paying for it?

To paraphrase Buffett, if you look around and don't see anyone paying for it, then you're paying for it.

There ain't no such thing as a free lunch 🤷

How are you paying for the volatility? By taking on invisible risk.

As Naval said on Twitter,

The volatility isn't disappearing. It's piling up silently, in an invisible corner.

It's like the crazy California forest fires of 2020.

In prehistoric California, 5-12 million acres burned each year, naturally. Over the last few decades, through strong government intervention, this dropped to 13,000 to 30,000 acres per year. Good job!?

Result: 5 of the 10 biggest wildfires in California history, erupted in 2020.

In the same way, dampening all the volatility of crypto could result in the mother of all crashes.

The Mother of all Crashes? Theatrical, much?

Theoretical too, you might say. Why do I think this could *actually* happen?

Because, Tether.

Tether, or USDT, is the most widely used stablecoin. And of all the major ones, it's on the shakiest foundations. Its peg to the US Dollar is the most fragile.

If you look at the big ones, USDC is fully collateralized with USD. For every USDC that any investor holds, Circle (the consortium that manages USDC) holds a US dollar in reserve.

DAI is over-collateralized with ETH.

USDT, on the other hand, is only partially collateralized.

Tether of course says it has sufficient collateral. But look under the hood, and the story is very different.

Like a leveraged fund, it likely has less than 25% "real" collateral (and actual cash is just 3%).

Tether's parent, Bitfinex, is not exactly known for its corporate integrity.

And if you’re searching for some confidence in Tether itself, you won’t find it in this interview of the company’s leaders (found via the excellent Matt Levine).

As they say at the 12:50 mark:

We maintain cash that is many multiples above our single biggest redemption thus far, and above our biggest 24 hour period of redemptions. So we're quite comfortable with our reserves.

Wow, that sounds like... not much cash at all??

If this is true, then why has a crash not happened yet?

A crash won't happen overnight.

Whenever the USDT-USD rate moves a little below 1:1 (e.g., 1 USD = 1.005 USDT), arbitrageurs will come in and exploit the difference. They will sell USD to buy USDT, and thereby push USDT back up to 1 USD.

Why will they do this?

Because they "know" that Tether will honor the 1:1 peg. Even if they find no buyer later willing to pay 1 USD for 1 USDT, Tether will buy it back.

It all comes down to a (surprise!) trusted third party. Who'd have thought!

Now, let's say, during an especially volatile time, the peg moves a little farther than usual. It moves to 1 USD = 1.2 USDT, say.

What happens then?

If it's "common knowledge" that USDT isn't collateralized enough (i.e., everyone knows, and everyone knows that everyone else knows), then the trust is broken.

You know what happens next. A flight to safety.

Investors see the widening USDT-USD gap as proof the peg won't be maintained, and start selling USDT.

This pushes the price of USDT down even further. Driving more investors to panic-sell.

And so on.

Feedback loops are a fearsome thing. In a flash, the peg disintegrates.

Sounds like a movie?

Well, it’s a movie we’ve seen before.

Nat Eliason has written about the collapse of IRON here.

IRON is (was?) an algorithmic stablecoin, pegged to 1 USD. The peg was kept stable using a subsidiary token, called TITAN.

Won't go into the details, but before the crash, investors were flocking en masse to the protocol, because of the high returns on the TITAN token.

But slowly, and then suddenly, two things happened:

1. People began suspecting that the high returns on TITAN are not sustainable.

So the nervous investors began exiting en-masse.

And as more investors exited and the gap to the peg widened, others lost their trust that the peg will be maintained.

It became a self-fulfilling prophecy.

2. Iron was only partially collateralized. Like Tether.

And because everyone knew this, this only further fueled the flight to safety.

No wonder Vitalik Buterin calls Tether a "ticking time bomb" for Bitcoin.

But he's wrong.

It's a ticking time bomb for ALL of crypto.

A Tether crash won't just send a shock wave through crypto. It will be a cataclysm.

Does that mean I'm not bullish on crypto anymore?

Far from it. I continue to be bullish (although a little less than before).

As I wrote in A new blockchain based Internet is coming,

[The blockchain will] result in a foundationally different Internet. And a fundamentally different world.

Safer internet

Democratized entrepreneurship

Radical markets. In everything.

I still think the blockchain will revolutionize the world. I've written about decentralized insurance, as an example.

But I won't buy anything I'm not comfortable HODL-ing through the crazy times.

Because I might not have a choice.

Further Reading

Tether And The Great Crypto Ice Age

Nassim Taleb also makes a case for why Bitcoin is worth zero.

I disagree though - I think he gets a basic premise wrong. I've tweeted about it here.

2. COVID - the state of play. A story in 3 charts.

While Europe and the US are opening up, here in Asia, things are still pretty grim. Country after country is going into strict lockdowns. Singapore as well, where vaccination rates are very high.

The Delta variant has changed the dynamic, and has a few important implications.

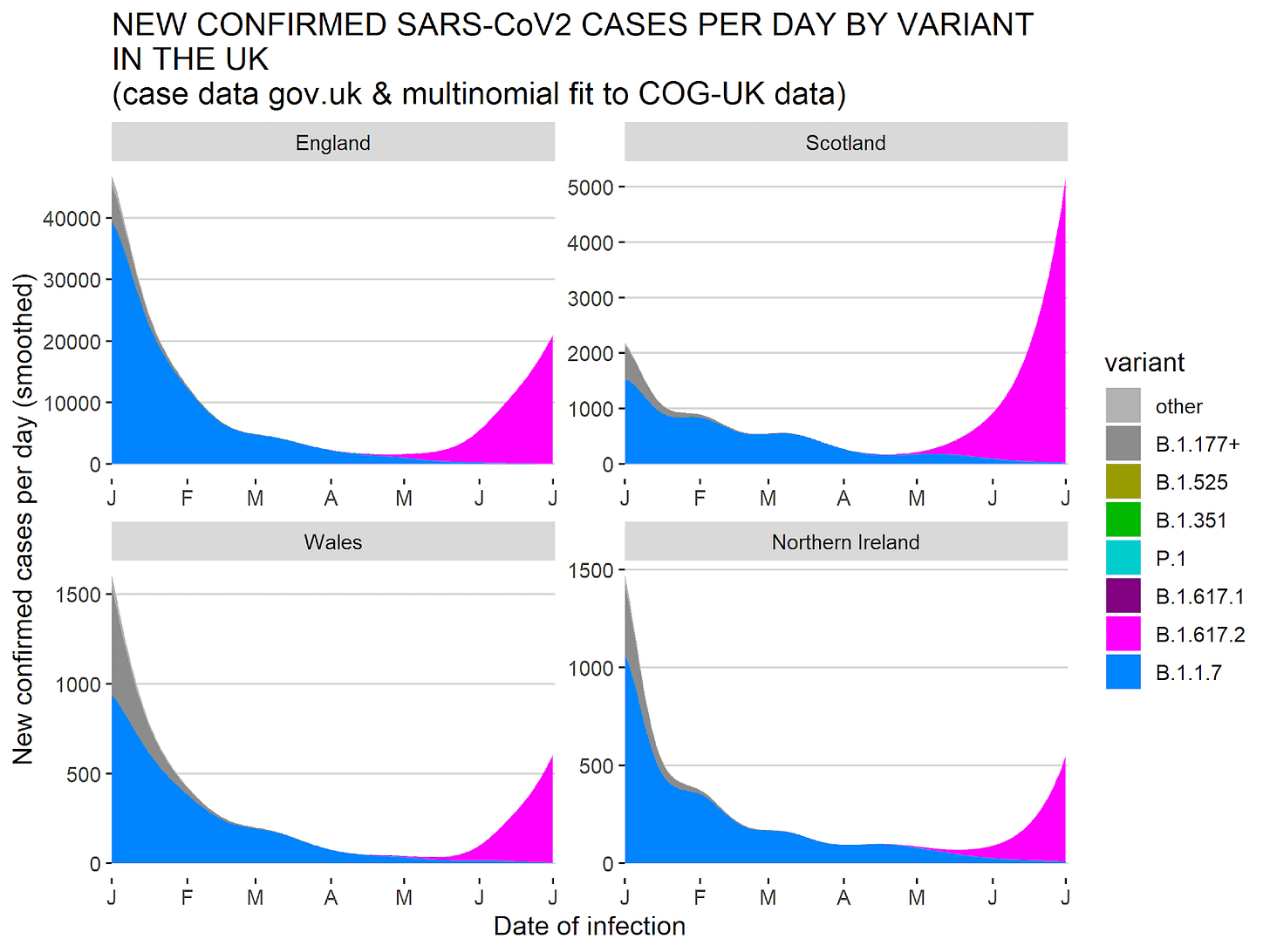

1. COVID-19 and Delta variant are now synonymous.

In the UK, it’s already 99% of cases as of beginning of July 2021. It'll soon be 99% of cases everywhere.

2. Herd Immunity is now a mirage.

Delta is far more transmissible than the original variant. The original variant had an R0 of 2.71, whereas Delta is at R0 of 4-9.

That might not sound like much. But it is.

Compounding may be the 8th wonder of the world, but in this case it is terrifying.

What does this mean for herd immunity?

It means that we will *never* reach herd immunity.

Delta is so contagious that we'll need 90%+ of the population to be immune, to reach herd immunity.

Oh, so it means we need 90% of the population to be vaccinated?

No, it means even 100% vaccination won't be enough!

Recall that even the best vaccines are <80% effective against Delta.

So, even if we vaccinate EVERYONE (won't happen), the virus will become endemic.

3. Vaccines are still the light at the end of the tunnel.

Even though vaccines don't give 100% immunity, they help. A LOT.

See the reduction in fatality in the UK between the 2nd and 3rd Waves.

COVID will be with us for a long time 😞. No herd immunity. We will all get it at some point.

The medium-term will be rough.

But with vaccines, we can be more optimistic about the long-term.

With most people vaccinated, the viral load will never get high enough. It will be another irritant, like the common cold.

TL:DR / What we should all do.

Get a vaccine, any vaccine, if you can.

Any vaccine is better than no vaccine.

A less effective vaccine today is better than the best one 2 months later.

Oh, and keep your guard up. That means masks don't go away for a while longer. And avoid super-spreader events if you can.

Further Reading:

Tomas Pueyo has written a great essay on the Delta Variant, and everything you need to know.

And this is a great thread.

That's it for this week! Hope you liked the articles. Drop me a line (just hit reply or leave a comment through the button below) and let me know what you think.

I’m getting my second vaccine dose in an hour (writing this on Saturday morning). Hope you’ve got yours too, at least the first dose.

Let’s beat this thing, slowly but surely. Until then, wish you good health, safety, and sanity.

PS. I’m slowing down a little bit for the next few weeks. Will be back to weekly soon!

Until next time,

Jitha