Sunday Reads #149: Birth of the Indian EV industry (it's thrilling to watch!)

+ Three things I find absolutely fascinating about it.

Hey there,

It’s been a while, hasn’t it!

I took a few weeks off the newsletter because I was traveling home to Mumbai. Visiting family and friends after 2.5 years was amazing.

But it also made me a little sad to realize how short life is. How little time I actually have left with them.

I couldn't help but think of Tim Urban's (Wait But Why) post on The Tail End.

The math is a haunting reminder, as @punk6529 says in his thread on how short life is.

It makes me wistful. But it also reminds me to be present and lean into every moment.

Nevertheless, I’m glad to be back and writing again. On to today’s newsletter.

1. Birth of an industry.

It's exciting to watch a new industry being born. And that's what is happening with EVs in India.

As I've watched new EV companies being launched every week over the last few months, I've wondered: Why now? Why is EV suddenly a thing?

So I was glad when Arpit and Venkatesh of Blume released a primer earlier this week: Demystifying Indian EV Ecosystem.

I also did a Twitter Space today with Arpit and Avinash (Co-founder & CEO - ElectricPe) to understand what's most exciting about the EV space right now.

You can listen to the Space by clicking here (236 people have listened so far!).

Three things I found fascinating:

A. The future is already here. And it's widely distributed.

There are two answers to my "Why now?" question on EVs.

The first, tongue-in-cheek, is this: "The right question is not "Why now". It's "Why 2018"?

That's when 2-wheeler EVs first became cheaper than bikes running on petrol. That's when the total cost of ownership (TCO) of 2W EVs became lower than ICE (Internal Combustion Engines).

But you'll notice - there is an inflection point in 2021-2022 as well!

This was driven by three factors:

EVs becoming even cheaper vs. ICE

Players like Ather, Tata, etc. releasing surprisingly good products

Petrol and diesel prices rising

One other thing surprised me. In most auto segments, EVs are already more cost-efficient than petrol / diesel vehicles!

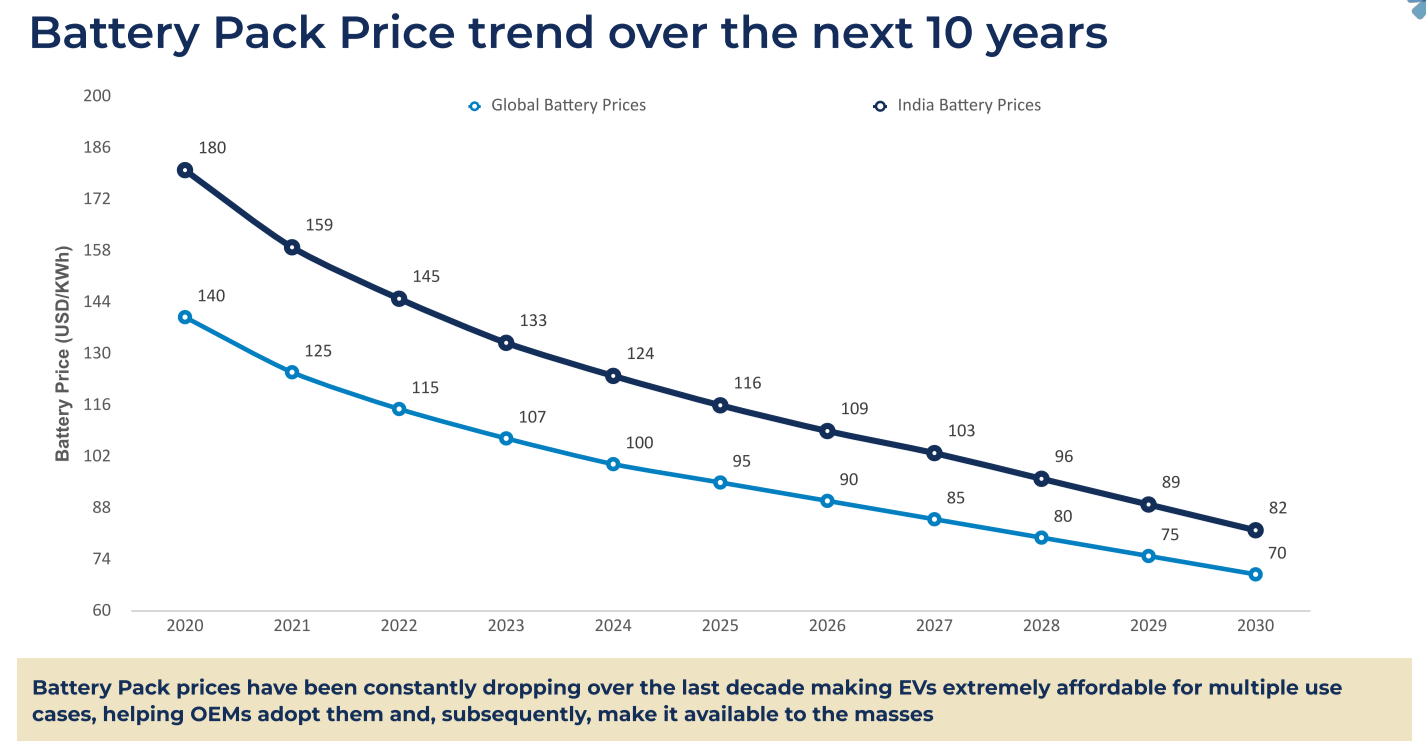

And with battery tech continuing to improve in the next decade, EVs will become more and more of a no-brainer!

So does this mean the sector is all set to boom?

"Everyone lives happily ever after". Show's over, let's go home?

Not quite. Because, you see...

B. The sector has a cold start problem.

Actually, it has four.

Sidebar: What's a cold start problem?

From Andrew Chen's book of the same name, a cold start problem is the chicken-and-egg problem that any multi-sided network faces.

e.g., when Uber launches in a new city, how does it get users when it doesn't have drivers? How does it get drivers when it doesn't have users?

I've written about this problem in multi-sided networks - and some strategies to solve it - in How Uber solved its Chicken and Egg problem (and you can too!).

Back to EVs: the cold start problem hasn't prevented players from coming in. The sector is crowded!

But low barriers to entry ≠ low barriers to scale.

The base technology seems easy, looking at the hundreds of companies sprouting up.

But the scaling problem is real. Very real.

Many of these companies will perish. They might have the consolation that they helped create a new, generational industry. Which won't be enough, of course.

Let's talk about the hardest of the four cold start problems: Lack of charging infrastructure.

Few vehicles → Charging infra is unviable → Fewer vehicles → ...A vicious cycle. Is there any way to break out of it?

There seems to be (at least) one clear path. With three steps:

i: Ignore Passenger EVs.

Realize that you don't have to solve this problem for everyone. Someone who's using their EV to commute to work won't have range anxiety. They can charge at home or office.

In fact, 80% of Passenger EV owners globally charge only at home / office.

ii: Focus on Commercial Vehicles.

Once you only need to support CVs, you don't need to blanket every city densely with charging points. Instead:

→ Just in key transport corridors

→ Next to delivery "dark stores"

→ Near main taxi hubs

iii: Reduce cost drastically.

Arpit and Avinash spoke about this on the Space.

Fast-charging infrastructure costs USD 15K-17K to set up. But it's now becoming possible to set up slow-charging infrastructure at USD 20-25 only.

So, in INR 1000-1500, a local kirana store can set up a charging point just outside the door!

Once such low-cost charging points become reliable, we will see an explosion of these across the major cities.

As per Avinash, the dream is to have 1 charging point per 250m-500m. ElectricPe, his company, has itself committed to aggregating 100K+ points by end-2022.

Exciting times ahead!

C. This is a once-in-a-lifetime opportunity to create EV companies.

When (not if) EV becomes a mainstay on the roads, the opportunity to innovate will be immense.

Think about it - the legacy auto industry has an long, serpentine and fragmented supply chain.

Now imagine - someone will have to do each of those individual pieces for EVs!

See the value chain below? Manufacturing, batteries, retail dealerships, after-sales, ...

Unicorns will be born in each of these boxes. Financing itself will have at least 20 unicorns!

Software is particularly interesting. EVs allow you to track more data about engine and vehicle health, and far more accurately. Which throws up a bunch of interesting ideas:

Tools that track your driving and nudge you to drive better

Automatic maintenance scheduling: your vehicle calls a service center as soon as it detects the battery is faulty

Pay-as-you-go financing / insurance models

This is an exciting space, at an exciting time.

As Arpit exhorted all the listeners at the end of today's talk:

"Consider joining the EV industry. It'll be the fastest-growing industry in India over the next decade.

Start a company. Join an existing company.

Just… don't sit on the sidelines."

Over a 10 year horizon, it would take a brave man (or a fool?) to bet against EV winning.

The folks at Blume certainly believe so:

But in the medium-term, I still have a few questions:

As incumbent auto majors enter this space, will they win? (Tata is already in, and the Nexon is surprisingly good!)

How can the government best support this sector to build capabilities locally?

What about the energy infrastructure itself? How can we scale it to match skyrocketing demand for electricity? While using clean sources rather than coal?

Would love your thoughts!

[PS. Given the strong response to our talk this morning, Arpit and team are thinking of setting up a Discord group of EV enthusiasts and entrepreneurs. If you would like to be a part of that, reply and let me know!]

2. Golden Nugget of the Week.

You can read all 499 pages of Thinking Fast & Slow to learn all about cognitive biases.

Or… you can just save this image.

3. A stat that blew me away.

Next time a crypto-maximalist screams at you, “It’s still too early!”, show them this stat.

Nope, it isn’t too early. Not anymore.

Substack is alerting me that I’m near the email length limit, so that’s it for this week.

As always, stay safe, healthy, and sane. I’ll see you next week.

Jitha