Sunday Reads #160: What sweaty Steve Ballmer knows about startups that you don't.

Gorilla, Chimp or Monkey: what kind of startup are you?

Hey there!

Hope you had a good week!

Back to regular fare, after last week’s article on angel investing.

This week, let’s talk about a powerful startup framework you didn’t know you needed.

1. If startups were a primate zoo, what kind of primate are you?

There are two types of founders.

The General: Always under siege. "We're getting slaughtered out there! We need to kill kill kill our competitors."

The Music Conductor: Pragmatic, calm and collected. Knows what matters. "We just need to worry about our customer, not the competitor. There's enough space in the market for all of us".

No prizes for guessing which type of founder I think I am.

But I'm here to tell you today that I'm wrong.

The pragmatic, calm and collected founder? He doesn't know what matters.

And the General is right. You're always under siege.

Now, I know what you're thinking.

Yes, there are network effects businesses. And in such businesses, it's important to press home your advantage. Fight hard, take no prisoners. There's only going to be one winner.

But not every business is a network effects business. If there's no network effect, then why does decimating your competitor matter? There really is enough space in the market for everyone.

Right?

I used to think that too.

In fact, many of my investments are with that exact thesis. Where I bet on a company because it has a chance to be a strong #2, even though the market leader is clear.

But I was wrong. To see why, let's talk about gorilla businesses.

What is a gorilla business?

I've said before that Geoffrey Moore's Crossing the Chasm has the highest insights-to-words ratio of any business book. It's a short book, but I'm still thinking about it more than a decade later.

Well, his interview with Patrick O'Shaughnessy has the highest insights-to-words ratio of any podcast I've listened to.

In the podcast, he talks about gorilla businesses.

What are gorilla businesses? In his words:

A gorilla business is a market share leader in a powerful category.

First, it's playing in a powerful category: a category in hypergrowth.

There's a "tornado of traction". Customers had no budgets for this category last year. But all of a sudden, now it's an absolute must-have. They're breaking the door down for someone, anyone, to sell them this product.

But a gorilla is not just any player in this category. It's the market leader.

Why is that important, if the sector is in hypergrowth?

Because when the dust settles, the gorilla will have a lion's share (err… gorilla's share) of the market.

The gorilla will be the market leader by far.

The no. 2 player will get only half the market share of the gorilla. Let's call them the chimp.

No. 3 will get half of what the chimp gets. They're the monkey, I guess?

What's more, the gorilla will get stronger and stronger over time. The monkey and the chimp will fade into irrelevance.

Don't believe me? Well, name an on-premise ERP other than SAP. Quick!

OK, how about a networking infra company other than Cisco?

Hmm, I can see you nodding your head, but you're only half-convinced. The examples are good, but anyone can cherry-pick.

It's far more important to understand: why does this happen?

Why does the gorilla win?

The gorilla wins because over time, it starts to define the industry standards. It becomes a platform that others build on top of.

Moore talks about a 2x2 between open vs. closed, and proprietary vs. non-proprietary.

A gorilla creates a network effect where none exists.

Developers build apps for Windows, or plugins for Shopify.

Entire consulting firms exist only to help companies install Salesforce.

System Integrators help companies set up Cisco networking infra.

When a company becomes an industry standard, it's a gorilla.

If you overhear people saying, "No one ever got fired for implementing X", there's a gorilla in the room.

Have you seen that video of a sweaty Steve Ballmer chanting "Developers, Developers!"? That's a gorilla. Apple's OS/X just couldn't compete with Windows’ developer ecosystem.

Once you've embedded yourself into an ecosystem, it becomes impossible for a competitor to dislodge you.

And the more you sell to that ecosystem, the better (and lower cost) your products become. Your competitors fall further and further behind.

And because you're the de facto standard now, all competitors are measured against you. And they fall short.

And then… you start expanding.

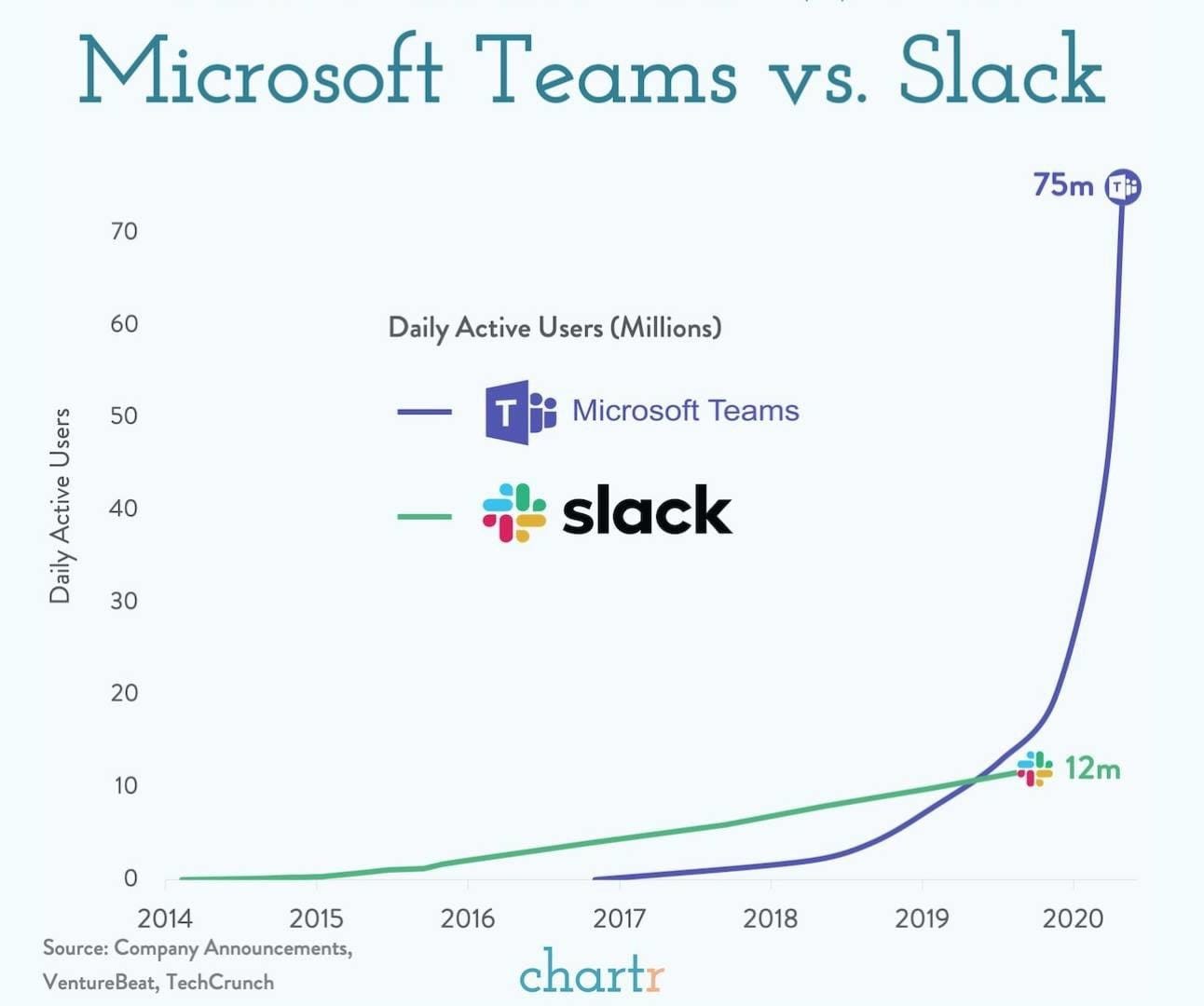

Like Microsoft did.

I wrote about this in How Microsoft became a multi-trillion dollar company. Once you have a foothold, you start offering other services. "Hey, you’re already using Windows, why don't you try my collaboration software (Teams)?". "You already use Office 365, why don't you try Azure for your servers?".

Result?

Like bowling pins, you pick off one adjacent segment after another.

This reminds me of Peter Thiel's comment on successful companies:

Ritesh Banglani of Stellaris says something similar, looking back at a decade of investments:

You could pick a good company in a high-growth space. But if it's not the market leader, you still lose.

Far more markets are winner-take-all than we realize.

Hmm. So does that mean a gorilla can never be defeated?

How can we push back against the relentless momentum of a market leader? If "winner takes all" is the moral arc of the market, then how do we eclipse it?

Before we continue, a quick note:

Did a friend forward you this email?

Hi, I’m Jitha. Every Sunday I share ONE key learning from my work in business development and with startups; and ONE (or more) golden nuggets. Subscribe (if you haven’t) and join 1,300+ others who read my newsletter every week (its free!) 👇

How to tame a neighborhood gorilla.

Once a category has a gorilla, the only way to disrupt it is to create a new category.

In the interview, O'Shaughnessy gives the example of left-lane vs. right-lane driving. Once a country chooses one of these, it can never change.

Until flying cars are invented.

You need two conditions to defeat a gorilla:

The incumbent technology / gorilla are trapping value. They're constraining the customer.

There's a new disruptive technology that can help release that trapped value.

Salesforce disrupted on-premise ERPs like SAP, only when Internet speeds became fast enough to offer services from the cloud.

Uber disrupted traditional cabs, by using mobile technology to hail cabs with the push of a button.

And so on.

In other words, when a paradigm shift happens in technology, it makes the gorilla's moat irrelevant.

As Benedict Evans says:

IBM, Microsoft and Nokia were not beaten by companies doing what they did, but better. They were beaten by companies that moved the playing field and made their core competitive assets irrelevant...

It’s not that someone works out how to cross the moat. It’s that the castle becomes irrelevant.

IBM didn’t lose mainframes and Microsoft didn’t lose PC operating systems. Instead, those stopped being ways to dominate tech.

That’s when you can defeat a gorilla. When a new disruptive technology comes into existence.

But what to do when there's no paradigm shift on the horizon? More specifically,...

What to do if you're a chimp?

What if you try try try to become the gorilla, but then you find out that you're not?

You thought you had a chance to win. But if Moore is right, the result is now pre-ordained. You're going to fight a war of attrition versus the gorilla, and then you'll lose.

What should you do? Admit defeat right away and save everyone the trouble?

No, you don't admit defeat. When you can't win a particular war, you just fight a different one.

Instead of fighting the gorilla head-on, you find another segment that you can dominate.

i.e., you become a gorilla in a smaller segment.

Moore gives the example of Oracle vs. Sybase:

In the relational database category, there was a concept called row level locking. Sybase did it one way and Oracle did it another way.

Because all the independent software vendors, the SAPs and the [Peoplesoft] and all the people that wanted to build applications on top of a relational database, had to choose. They went with the Oracle approach to row level locking, which disenfranchised the Sybase one.

And so Sybase... had to go into a specific market who said, we're willing to do your form of row-level locking because in the financial services industry, we have a bunch of problems that Oracle's not helping us with. You will help us with it.

Sometimes we call that "gorilla in the niche". It's the chimp strategy. The chimp can no longer compete with the gorilla head on across horizontal markets, but they can still win in verticals. And so that was what Sybase did on Wall Street.

Alternatively, you can look to get acquired by a gorilla in an adjacent segment.

Moore gives an example of Oracle vs. Informix this time (Oracle was quite the gorilla):

In the client server days, the relational database, there was Oracle, it was relational technology and there was Informix.

Gradually Oracle emerges as a gorilla, and even Informix were chimps.

And so what happened was Informix got acquired by IBM.

That's one of the things that a chimp can do is say, "Okay, I'm not the gorilla, so I need to join a bigger consortium."

To summarize:

Now, there's one more question left:

How to think about all this as an investor.

For those of us who are entrepreneurs, the concept of gorilla companies tells us how to compete. It's not a path for the faint-hearted, but at least it's clear.

What about as an investor?

Here, Moore's advice is simple:

→ When a sector is exploding, try and take positions in whichever company you can.

→ But once the pecking order is clear, exit the chimps and monkeys, and focus your investment in the gorilla.

Investors tend to overvalue the chimp and undervalue the gorilla.

Why? Because they have the wrong frame of reference. Traditional industries like auto are not winner-take-all. GM might be the leader, but Ford won't be far behind.

But technology / software businesses invariably end up as winner-take-all. The gorilla will get bigger and bigger, at the expense of the chimp.

Because the market doesn’t fully realize this, a gorilla will always be cheap.

So the playbook is simple:

First, invest in any company you can, in a hypergrowth sector

Once it’s clear who the gorilla is, sell the others and concentrate your investment in the gorilla

Remember: If David and Goliath are fighting with the same weapons, Goliath will win. Bet on Goliath.

PS. If you’re an investor, pair this with last week’s article: 3 reasons angel investing doesn't work (and 3 secrets to do it right).

2. Golden Nugget of the week.

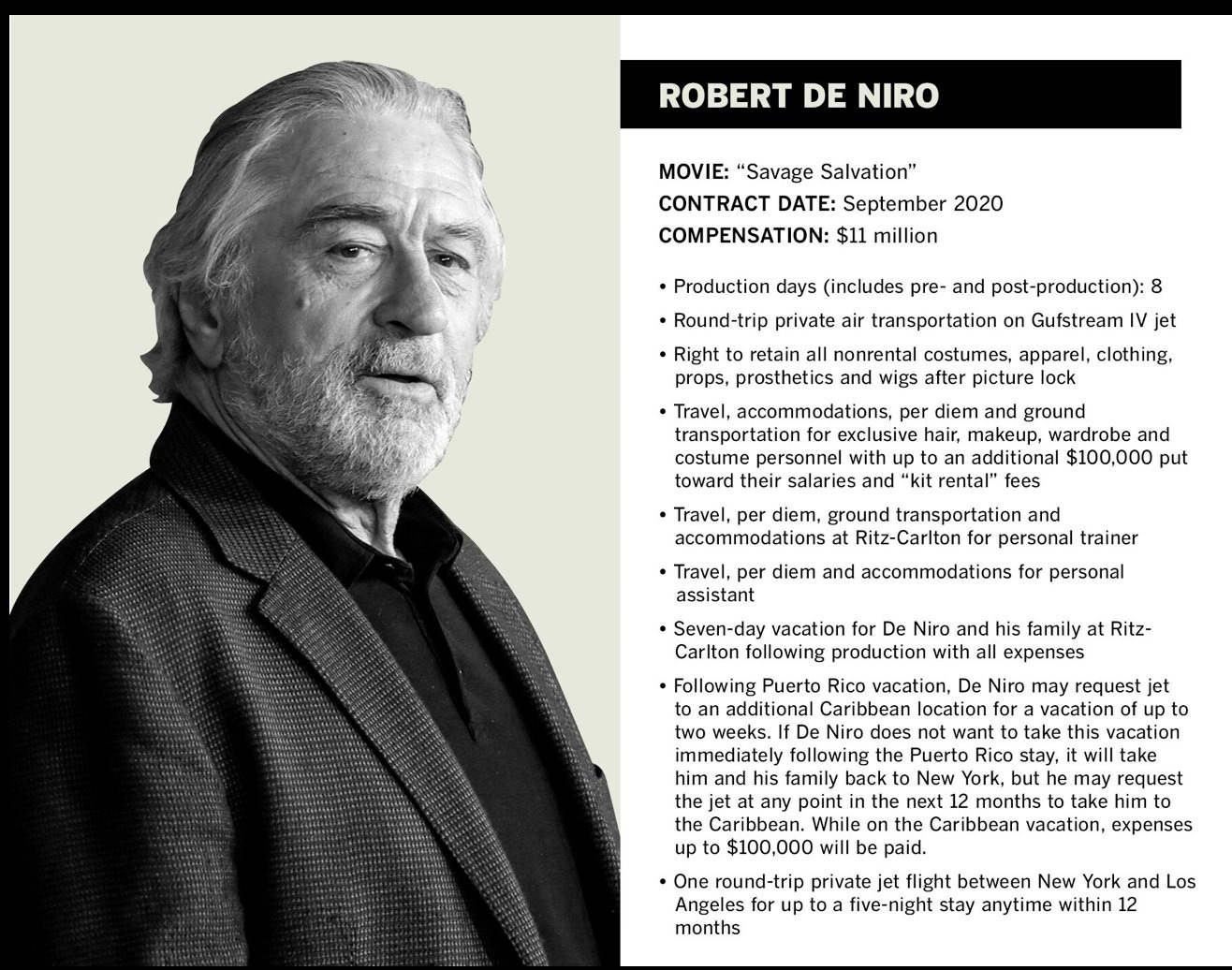

Robert De Niro might well be the world's best negotiator.

What he got for 8 days work:

$11 million

Round trip on a private jet

7 days all-expense paid vacation for his family

In case the first vacation isn’t enough rest, another Caribbean vacation with $100K of expenses covered. Anytime in the next 12 months!

Another round trip on a private jet to New York, because… why not!

Two thoughts:

(a) It's insane. But more importantly;

(b) it shows the importance of asking for many things, instead of one big thing.

I like to call this the Long List Strategy. The more things you can ask for (and the more "valuable" things you can give up), the higher the likelihood that you'll get what you want.

Plus it helps to be De Niro.

3. Chart of the week.

Lenny Rachitsky has a good chart on how B2C startups came up with their ideas:

Now, there are some common tropes about finding startup ideas:

Solve your own problems

Listen to the customer

But it looks like they don't apply to B2C.

By just following your curiosity, or brainstorming and trying different things + doubling down on what works, you can unearth a massive opportunity.

The article lists a few more strategies to find startup ideas. Check it out here.

4. This made me laugh out loud 😆

There's been a TON of discussion online recently, about whether Web3 has any use cases or not.

Strident and loud voices on both sides.

In that vein, I loved this meme.

That’s it for this week. Hope you enjoyed it.

As always, stay safe, healthy and sane, wherever you are.

I’m moving house next weekend, so I won’t send out the newsletter next week. Will be back in your inbox the Sunday after.

Until then,

Jitha