Sunday Reads #182: Network effects, the physical kind.

There's this bar... where all the rich people hang out...

Hey there!

Hope you’re having a great weekend.

Sorry I didn’t send a newsletter the last couple of weeks - couldn’t read or write much, as I was traveling a lot!

In case you missed my last newsletter (my learnings from a workshop with Paddy Upton, the World Cup winning cricket coach), you can find it here: What I learnt from 6 hours with a World Cup winning coach.

This week, let’s talk about network effects. Actually, a specific kind of network effect.

1. “If you want to start a tech company, go to Silicon Valley”.

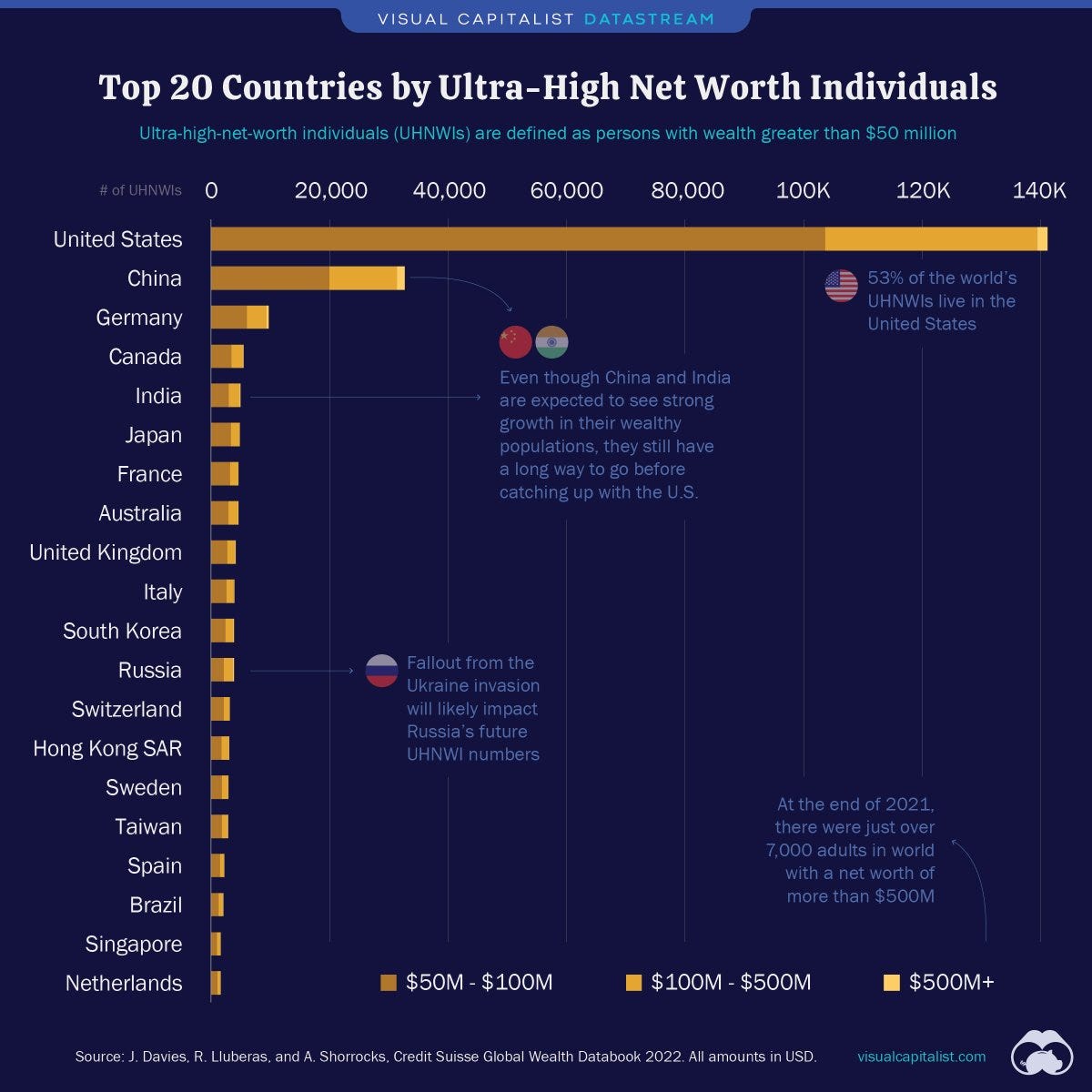

I saw this chart recently, and I've been thinking about it a lot.

The US has such a disproportionate share of the ultra rich!

Why is it that success seems to cluster so remarkably? What can we do about it? Is there some way to harness this to our advantage?

With these questions swirling in my head, I went down the rabbit hole this week.

My first lesson was:

A. Geographical Network Effects are Real!

No surprises on this one.

You see geographical clustering across countries.

The net worth distribution up top is a great example.

The US has 53% of the world's ultra-high net worth individuals. Despite only having ~4% of the world's population.

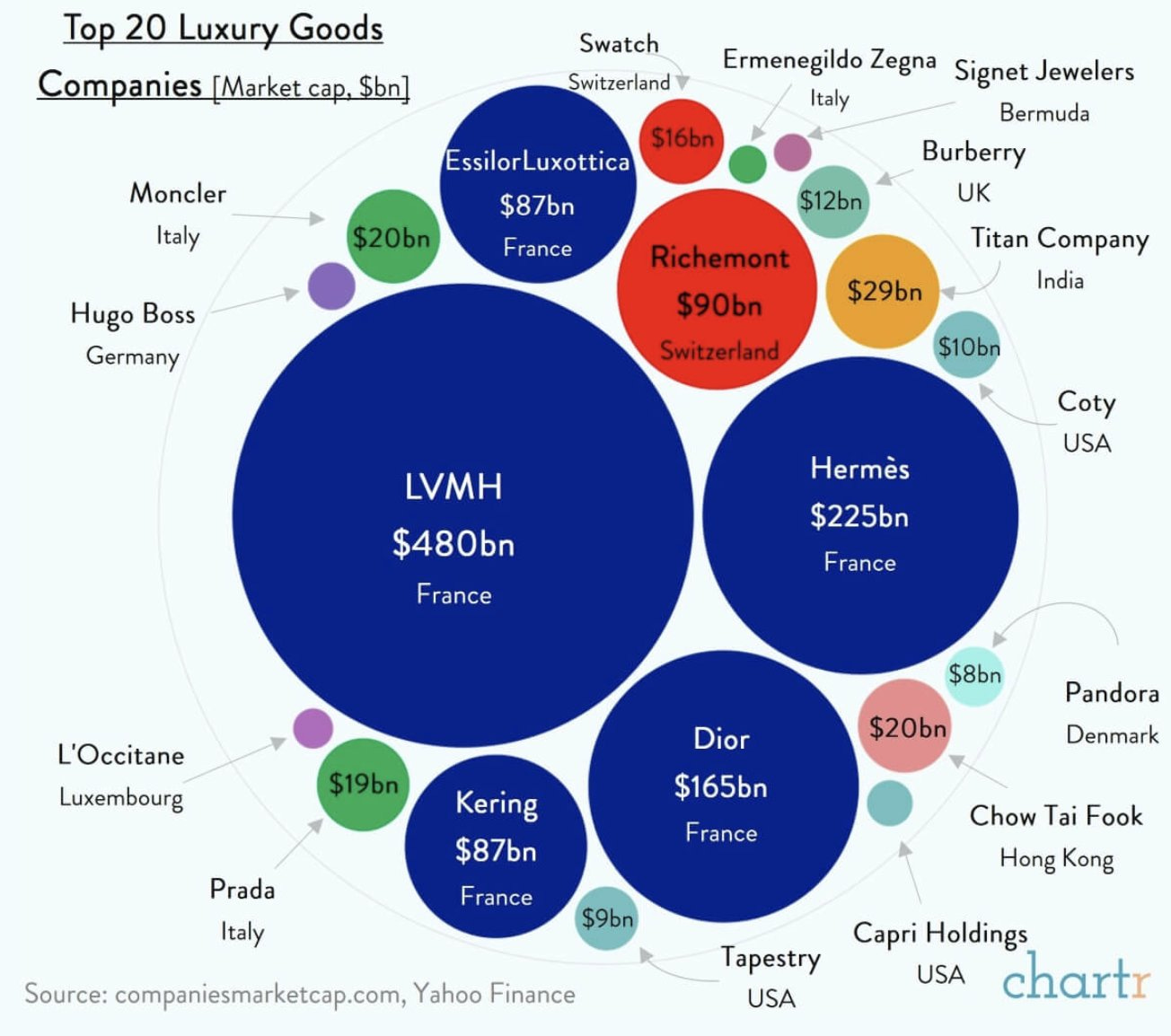

You see it in the luxury industry.

(the blue circles are French companies).

You see it in innovation and tech.

As Ethan Mollick says on Twitter,

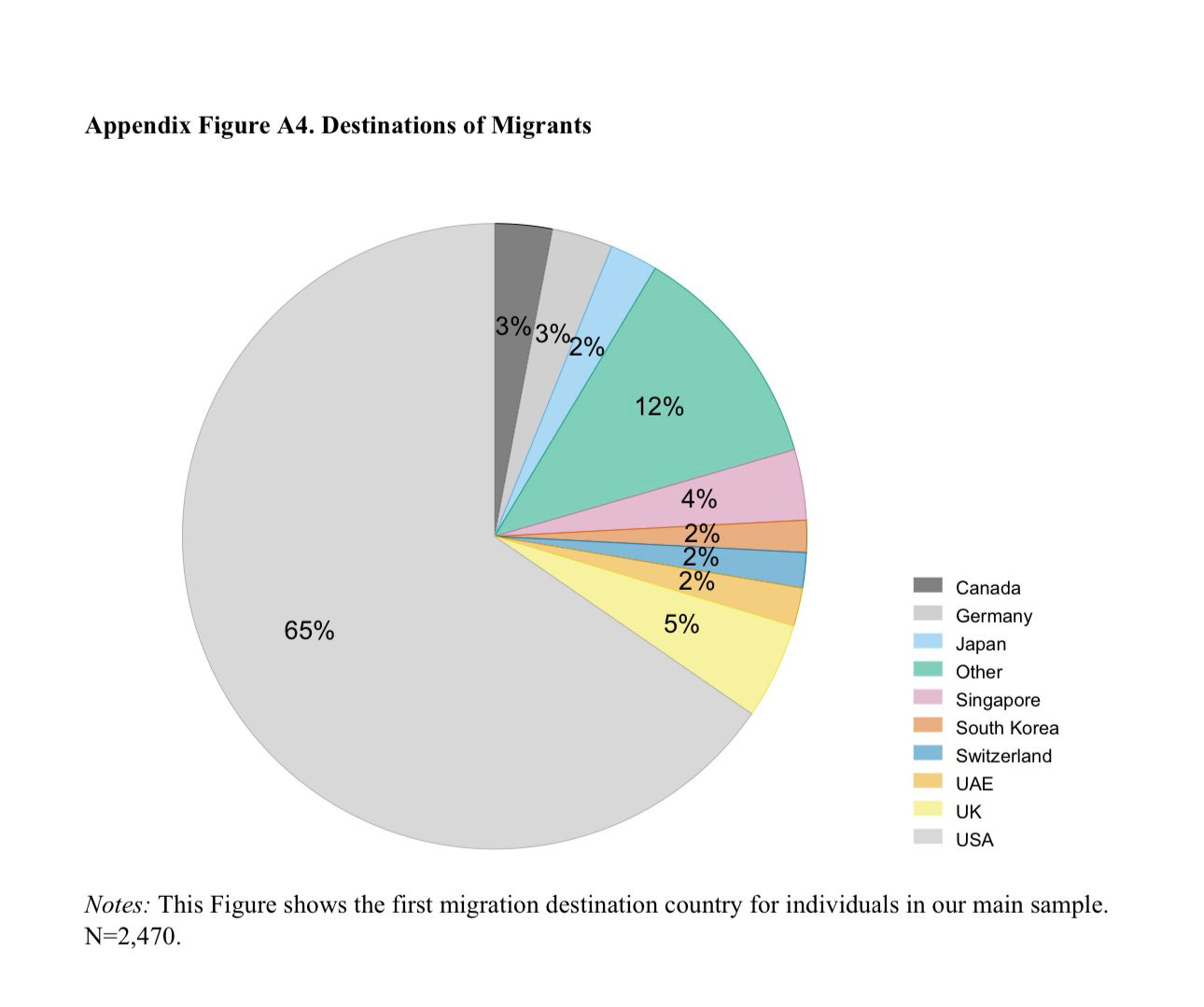

54% of ALL migrant inventors in the world have historically come to the US.

For the best technical talent from India, that number is 65%.

You see it in football! (will be obvious to most fans).

As Maia Mindel wrote in Why Nations Win (World Cups), after last year's crazy final:

[Some countries are extremely dominant in football. There seems to be a clustering of football world cup victories.]

... of the past 7 World Cup finals, France has made 4 (1998, 2006, 2018, and 2022) and of the past nine, Argentina has made three (1990, 2014, and 2022).

Since 1970, only two teams that aren’t Argentina, Brazil, Germany, France, Italy or the Netherlands have made a final: Spain (2010) and Croatia (2018). And only two other teams (England and Uruguay) have *ever* won the Cup.

Zoom in, and you see clustering across cities too, within countries.

From Elad Gil's Industry Towns:

If you were going into the movie business, you would be encouraged to move to Hollywood, Lagos, or Mumbai. If you wanted to go into finance, New York, London, and Hong Kong would be amongst the primary places to move. Industry towns exist for most major industries, including energy, finance, movies and entertainment and other areas.

And you see this in tech as well.

In every market one city takes most of the market cap. For example, London is 66% of the private unicorn market cap in the UK, Silicon Valley is 57% of US market cap, and Berlin is about half of Germany's.

India is unique in having two cities of roughly equal unicorn market cap with 6 unicorns in Bengaluru and 8 in New Delhi together making up 78% of Indian unicorn market cap.

Zoom in some more, and you see clustering within cities!

As Marco Leonardi and Enrico Moretti say in a new AER Insights piece:

We estimate agglomeration externalities in Milan’s restaurant sector using the abolition of a unique regulation that restricted where restaurants could locate. In 2005, Milan abolished a minimum distance requirement that had kept the number of establishments artificially constant across neighborhoods. We find that after 2005, the geographical concentration of restaurants increased sharply and at an accelerating rate.

Consistent with the existence of strong and self-sustaining agglomeration externalities, restaurants agglomerated in some neighborhoods and deserted others, leading to a growing divergence in local amenities across neighborhoods. Restaurants located in neighborhoods that experienced large increases in agglomeration reacted by increasing product differentiation.

It really is clusters all the way down.

OK, so geographical network effects are real. Which leads to the next question:

B. Why does such clustering happen?

From Elad's article:

Industry towns self-perpetuate as you have a critical mass of talent, suppliers, customers, investors, and know-how in a single geographic area. A cluster, once it exists is self perpetuating and attracts more of the same.

So why are industry towns so powerful?

1\. Talent base.

2\. Early customers

3\. Unique insights and know-how.

4\. Smart investors.

5\. Service providers.

6\. Living and breathing a craft.

It's the classic Network Effect loop. Each new member that joins the cluster makes it more valuable for existing members of the cluster.

And of course, if you're large enough, you can create a cluster yourself. Seattle is a tech hub because Bill Gates decided to set up Microsoft HQ there.

Which leaves the most important question of all:

C. What can you do about it?

I read a book several years ago called How to Get Lucky. (Aside: Amazon says I bought it a day before my birthday in 2015, so I dunno what I was expecting).

One of the secrets to harnessing luck that the author mentions is, "Go where the fast flow is". Open yourself to luck by going where more things happen.

Incidentally, that's one of the reasons why immigrants to the US tend to do better than locals.

From Tyler Cowen:

According to Boustan and Abramitzky, the secret weapon deployed by immigrant parents wasn’t education. It wasn’t a demanding parenting style like the one described in Amy Chua’s “Battle Hymn of the Tiger Mother,” either.

It was geographic mobility. Immigrant kids tended to outperform their peers from similar economic backgrounds because, unencumbered by deep hometown roots, their parents were willing to move to where the jobs were. If you compare immigrants to similar native kids born in the same place, they succeed at similar rates. It’s just that immigrant kids are much more likely to have grown up in one of those high-opportunity places.

“Immigrants are living in locations that provide upward mobility for everyone,” Boustan said.

This doesn't mean you can't succeed anywhere else.

Thankfully, you can still build a great business out of Bhopal or Raipur or anywhere with good Internet access. But it will be more challenging.

From Elad's article:

If you want to go into the movie business and someone told you to go to San Francisco instead of Hollywood, you would think they are nuts. It does not mean that you could not have a movie career in San Francisco - but it would be more challenging.

Movies are written by authors who could live anywhere, are filmed onsite around the world, and could be digitally edited from anywhere. Actors could fly to any site in the world to act. But for the Western markets most of the critical mass of the industry still happens in Hollywood.

This exchange on twitter is also instructive.

So if you can, don't handicap yourself.

Go where the fast flow is.

Before we continue, a quick note:

Did a friend forward you this email?

Hi, I’m Jitha. Every Sunday I share ONE key learning from my work in business development and with startups; and ONE (or more) golden nuggets. Subscribe (if you haven’t) and join over 1,500 others who read my newsletter every week (its free!) 👇

2. Golden Nugget of the week.

In my last newsletter, I shared some leadership lessons I learnt from 6 hours with Paddy Upton, a World Cup winning coach.

There was one other golden nugget from the workshop.

Paddy said:

There are two main obstacles to performance and life - Pressure and Fear.

You feel pressure because you place extraordinary importance on success. You need to WIN!

You feel fear because you need to not fail.

How do you overcome these two obstacles?

By separating your personal identity from results.

Anindya Dutta, who was co-hosting the workshop with Paddy Upton, recounted another anecdote from his banking days.

At the end of a very profitable quarter, Anindya had a disastrous trading day. Everything went wrong. He kept doubling down on his bets, and before he knew it, he had blown his full quarter's profits. In 2 hours.

As he was screaming at himself, his boss quietly told him, "Anindya, no one has died. It's OK".

And that's an important thing to remember:

Most of us are lucky enough that our mistakes won't matter much in the larger scheme of things.

So let's not worry about failing, and just do our best.

They're the same picture.

3. Chart of the Week.

I saw this chart from Aviral Bhatnagar on Twitter:

As Aviral points out, it's not surprising that players like Tiger Global and Softbank rank at the top. When you're investing $100M-$200M, you can make a company a unicorn just by investing.

But it's incredible that Y-Combinator makes this list. They invest SO EARLY!

No wonder Paul Graham keeps tweeting about how easy it is to identify successful startups. It is easy! For him!

4. I predicted this! But didn't expect it to happen so soon 🙃.

At the start of the year, I tweeted this:

What we hope for: AGI will give us boundless free time to do whatever makes our hearts sing, in a post-scarcity world.

What will actually happen: We will have to do captchas all day.

Well, looks like the all-day captchas have already arrived. Several years ahead of schedule. 😰

That’s it for this week. Hope you enjoyed it.

As always, stay safe, healthy and sane, wherever you are.

I’ll see you next week.

Jitha

[A quick request - if you liked today’s newsletter, I’d appreciate it very much if you could forward it to one other person who might find it useful 🙏].

That was an amazing edition!