Hello there!

Shorter post this week, and it’s not about blockchains. Or, it’s not only about blockchains 🤷♂️.

If you missed last week’s post on NFTs, you can find it below. Lots of readers wrote in that they loved it.

I also got quite a few questions. I’ll write a follow-up next week - sorta like an FAQ on NFTs.

(Make sure to subscribe if you haven’t!)

Back to this week’s post.

One of the common themes of this newsletter is the megatrend of decentralization.

I wrote about it in How the Gamestonk game will stop:

1. The current financial system is antiquated. T+2 day settlement, collateral requirements, etc. all fail in extreme scenarios. And in our exponential era, extreme scenarios will happen again and again. And the system will break, right when it needs to be strongest. You'll be locked out of your account right when your livelihood depends on you making a trade.

2. The system and its gatekeepers strongly favor the rich. In this case, the hedge funds could go on trading GME and covering their positions, even while retail investors were locked out.

"Who watches the watchmen" is an age-old question. The 21st century has an answer: Irrelevant. Just use blockchains.

I also wrote a thread about Etherisc - a decentralized insurance solution:

Yes indeed, blockchains will play an important role in decentralization.

But as promised, we won’t talk about that yet.

Instead, let's talk about cities.

One of the interesting symptoms of decentralization is this:

Local governments are taking much greater control of their own fates.

The most fascinating example of this is Francis Suarez, and his one-man evangelism to make Miami a parallel tech hub.

It all started with this now-legendary tweet:

A bunch of cities are trying radical new experiments.

Wyoming now has a DAO-friendly legal structure. Competing with Delaware, the state where most US tech companies traditionally incorporated.

Colorado is experimenting with quadratic voting. (Learn more about quadratic voting from this excellent book Radical Markets).

We also have charter cities, built entirely from scratch!

Prospera: A charter city in Honduras.

CityDAO: "We're building a city on the Ethereum blockchain" (in a parcel of land in Wyoming).

Telosa: "A new city in America that sets a global standard for urban living, expands human potential, and becomes a blueprint for future generations".

And competition between cities is getting more brazen than ever.

See this exchange between Francis Suarez (Mayor of Miami) and Eric Adams (Mayor-elect of NYC).

"I'll take one month's salary in bitcoin.". "Ha! I'll take three!".

Feels like bidders at an auction, vying for a first edition of a widely available document.

Another example:

I've written before about how a simple bottleneck at the Los Angeles port triggered a worldwide supply chain crisis.

Even as LA is moving to unclog this bottleneck, Texas has lost no time to present an alternative.

“Escape California. Choose Texas”.

Now, a couple of observations. One obvious, and one not so obvious.

#1: Yes, blockchains / Web3 will be an interesting medium for cities to do these experiments.

As Vitalik Buterin says in Crypto Cities, there are two ways in which using a blockchain can help cities.

Create more trusted, transparent and verifiable versions of existing processes.

Implement new and experimental forms of ownership for land and other scarce assets, as well as new and experimental forms of democratic governance.

But there's a more important question to ask.

#2: Why are these cities suddenly competing? What's the prize they're vying for?

You, dear reader. They are competing for you.

Sometimes you know how valuable you are. Sometimes you don't know, but the market tells you.

And in case you missed it, Portugal is rolling out the red carpet for you.

And here's a list of other countries inviting digital nomads. (Croatia would be my personal pick - Zadar is my favorite city in the world).

When cities and nations are competing for your patronage, it's time to stop and ask: Why?

It's a sign that you're far more mobile than you think.

You no longer have to be stuck in one country or city; you can actually move.

If you don't feel mobile, well, question your assumptions. The market is giving you a signal.

As I said in The Remote Revolution is coming:

If employees prefer remote work, then there will be some who are willing to change jobs, to move to an employer who supports a remote working culture.

In the marginal case, guess which employees jump ship first? The ones with the most critical skills, who will be rehired by someone else in a heartbeat. The ones your company would most sorely miss.

Ergo, you (and your company) will also embrace a remote-friendly work culture. You just don't know it yet.

Bet on a future that will benefit from remote work.

Cities and countries are already seeing this coming reality, and are betting on it.

When will you (I) realize it?

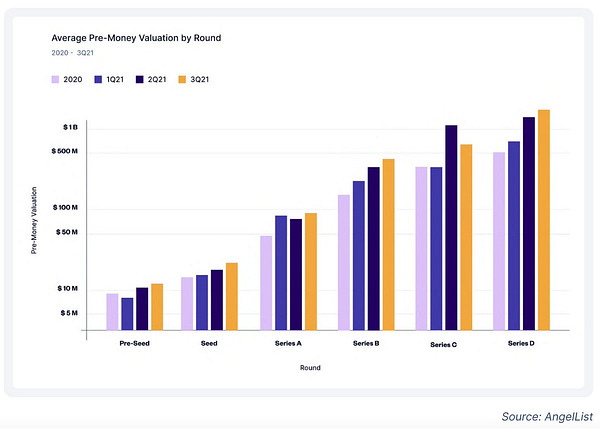

Chart of the week:

Venture capital is just one example. Wherever you look, rounds are getting bigger. Prices are getting higher.

What’s happening!

There’s a name for this phenomenon - Zero Interest Rate Policy (ZIRP).

I wrote about this in May last year, in What the hell is going on with the stock markets?:

Money is always swimming towards yield. All of capitalism rests on this constant flow - of investments in search of return.

Strange things happen when the risk-free rate nears zero.

When interest rates are near zero, even a slight increase in yield feels like an immense reward for taking risk.

And this is what is happening now. The yield curve is flattening.

Golden Nugget of the week:

This is more than a nugget. I loved this visual explanation of the art of meditation.

Hope you enjoyed reading today’s edition of Sunday Reads!

Would love if you could also share it on Twitter so more people can see it. Thanks a lot!

And remember to subscribe (if you haven’t), so you don’t miss the next one!